IT IS the nature of columnists to look for historical parallels, as they provide a good peg for discussing current conditions. So it is hardly surprising that Gillian Tett of the Financial Times, who made her reputation with her acute coverage of the 2008 crisis, has sounded warning signs about a repeat and indeed about central-banker complacency on the subject. On September 1st, she wrote of the "peculiar distortions" in the financial world, notably that

anybody who deals with financial markets on a macro level today—as a banker, asset manager or corporate treasurer—knows that many asset prices are extraordinarily elevated.

This is true, although of course, bond yields have been at historical lows for some time, and the cyclically adjusted price-earnings ratio of US equities (currently 27) has been well above the historic average since 2009. The question is when things will right themselves; the Spectator called the top of the bond market in 2011 and this blogger has been pessimistic about the long-term prospects for equity returns in the face of an extended (albeit volatile) bull market.

So the temptation is to cry wolf too early. George Soros raised the 2008 comparison at the start of the year (as discussed in an earlier blog) when markets were concerned. That episode focused more on the Chinese economy, suggesting the right comparison was with the Asian crisis of 1998, rather than the 2008 episode. Since then, the Chinese economy has done little to justify the more extravagant warnings of the doomsayers.

Clearly, there are similarities and big differences between now and a decade ago. The 2007-08 crisis stemmed from a spectacular growth in debt that was secured by property assets (mainly in America but also in Britain, Spain, Ireland and elsewhere). Investors had taken false comfort from the idea that all property prices would not fall at once. Indeed, this confidence pushed up prices; because homebuyers and lenders believed that house prices could not fall they were willing to pay/lend against any price. And that led to the collapse.

This time round we have not seen the same spectacular growth in overall debt except in China. That country lacks the market mechanisms to expose balance-sheet weakness and even if it did emerge, the feeling is that the authorities have enough firepower to deal with the problems. Perhaps that view is complacent although, again, it is hard to see what might trigger the crash.

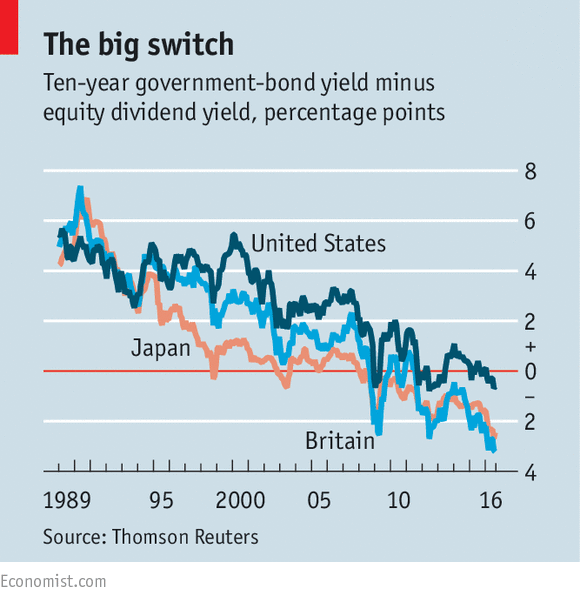

The broader argument made by Ms Tett suggests that things are even worse than in 2008; all asset prices are inflated. Certainly a world where in early July, some $10 trillion of debt traded on a negative yield is arguably crazy. More fundamentally, as a recent column pointed out, we seem to have entered a new (or rather revived era) when government bonds yield less than equities (see chart); this time really is different.

However, the problem with a government bond bubble is deciding what can pop it. There are two possibilities; default and inflation. Default can happen in countries where there is no, or limited, central bank support (Greece, for example) but it is hard to see the Fed, ECB, Bank of Japan or Bank of England pulling the plug on their governments. The sheer scale of central bank bond purchases may eventually lead to high inflation but it hasn't yet and there seems no imminent prospect of rapidly-rising prices.

Another problen with the analogy is that we lack the kind of widespread enthusiasm for financial assets that was seen back in 2006-07; people own equities and bonds because they have little choice when cash yields zero. A dire outcome might emerge eventually (history suggests it probably will). But unless you think it is about to happen imminently, the 2008 comparison doesn't stand. Indeed, by the end of the piece, Ms Tett has retreated from it, writing that

In the short term, these sky-high asset prices seem unlikely to produce a full-blown 2008-style crisis... Moreover, it seems that those rock-bottom low rates reflect long-term structural issues—such as ageing demographics and falling productivity—as much as central bank interventions. This suggests they could endure for a long time.

Could the crisis emerge from elsewhere than the government bond market? Corporate profits are high as a proportion of GDP and could fall, giving a shock to the stockmarket. But as we saw in 2000-02, an equity sell-off has less severe economic consequences than a credit squeeze. President Trump might, as he has hinted, default on Treasury bonds or so disrupt geopolitical and trade relations that a slump results (the latter would be good for T-bonds, of course). But that wouldn't really be a 2008-style crisis; we would be looking for comparisons with the early 1930s. So, by all means, use historical parallels; we should just be a bit more imaginative with our selections.

No hay comentarios.:

Publicar un comentario