About half of Federal Reserve officials expect the economy will improve enough to warrant an end to QE3 later this year, according to minutes from the central bank's June meeting, released Wednesday.

About half of Federal Reserve officials expect the economy will improve enough to warrant an end to QE3 later this year, according to minutes from the central bank's June meeting, released Wednesday.

"About half of these participants indicated that it likely would be appropriate to end asset purchases late this year," the minutes said.

A "few participants" also thought the Fed should have started slowing or even stopped, their asset purchases at the June meeting.

In Fed-speak, "participants" refer to 19 people who debate monetary policy at the central bank's meetings. These people include all seven Fed governors based in Washington DC, and 12 regional Fed presidents from around the country. However, only 12 people get to vote on Fed policy.

The minutes seem to indicate the voters are leaning a bit more toward caution, than the rest of their colleagues. Many still want to see more improvement in the job market before they'll be ready to start winding down QE3. Investors welcomed that news andstocks rose shortly after the minutes were released.

"Many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases."

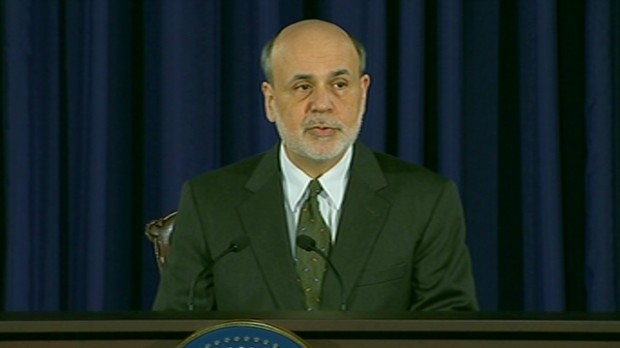

That seems more consistent with an outlook presented by Federal Reserve Chairman Ben Bernanke at a press conference last month. He laid out a scenario in which the Fed would start cutting its monthly asset purchases gradually this year, but not end them until mid-2014, as long as the economy improves and the unemployment rate falls to around 7%.

That announcement initially sent stocks plunging and interest rates climbing, until Bernanke's colleagues took to the speaking circuit in full force, to calm investors' nerves.

The Fed's controversial stimulus program includes buying $85 billion in Treasuries and mortgage-backed securities each month, in an effort to lower long-term interest rates. It marks the third round of so-called quantitative easing, which is why it's nicknamed QE3.

No hay comentarios.:

Publicar un comentario