It should be another good year for the stock market. Not spectacular, but positive.

That's the general consensus among the investment strategists CNNMoney polled in a recent survey. See the full results here.

Of course, some were more bullish than others, and one was downright bearish.

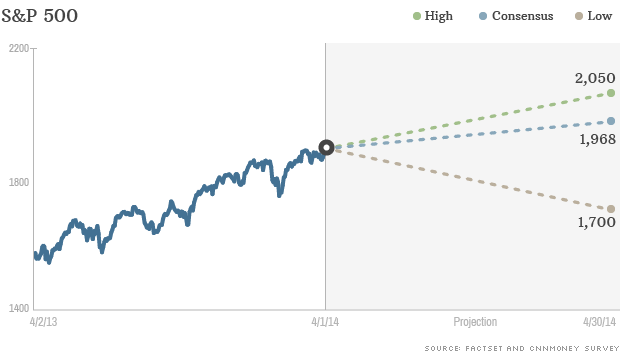

Gary Flam, a portfolio manager at Bel Air Investment Advisors, had the lowest target for the S&P 500 among the 26 investment professionals in CNNMoney's survey. He expects the index to end 2014 at 1,700, which would translate to a drop of 8% compared with 2013.

On average, the strategists are expecting the S&P 500 to rise 6.5% to 1,968.

Flam acknowledged that the outlook for economic growth has improved and some headwinds have abated. "Yet there are still significant risks that don't justify an above average multiple for the markets," he wrote in his survey response.

On the other end of the spectrum is Joseph Tatusko, Chief Investment Officer at Westport Resources. He expects the S&P 500 to gain nearly 16% this year to 2,143, based on the contention that that stocks "appear reasonably valued."

"Assuming continuing economic expansion and corporate profit growth we think a 10% to 15% return this year is achievable," Tatusko wrote.

We also asked if a price bubble could be forming in some sectors of the market, including biotech/healthcare stocks, small-cap stocks or Bitcoin.

Some acknowledged that healthcare/biotech and small-caps were overvalued, but few were concerned about a bubble.

"Biotech is the one group that is probably closest to a bubble," said Ryan Detrick, an analyst at Schaeffer's Investment Research. "Still, the thing to remember is bubbles can last a lot longer than most think."

Biotech reckoning?

Bitcoin, on the other hand, is definitely a bubble ... except maybe it's not.

The vast majority of the strategists who responded to our survey did not offer an opinion on what the digital currency should be worth.

Those who did ranged from zero on the low end, to $1,000 on the high end. But even the most optimistic forecast came with a disclaimer: "Who really knows?"

The problem, some respondents said, is that it's very difficult to come up with a fair value for Bitcoin.

"Its intrinsic value is zero. Its market value is whatever everyone else thinks it's worth to everyone else," said Brian Jacobsen, portfolio strategist at Wells Fargo Funds Management. "It's like a snake eating its tail."

No hay comentarios.:

Publicar un comentario